Gross Domestic Product by Metro

Posted on 10/09/2018 by Beverly Kerr

- Austin’s economy grew an outstanding 6.9% in 2017, making it the second fastest growing major metro economy.

- Natural resources and mining was the most significant driver of Austin’s GDP growth in 2017, but wholesale trade and financial activities were also important.

- Real per capita GDP is up 4.1%, making Austin the second best performing major metro.

- While Austin ranks as the 31st largest metro based on population, its economy ranks as the 24th largest.

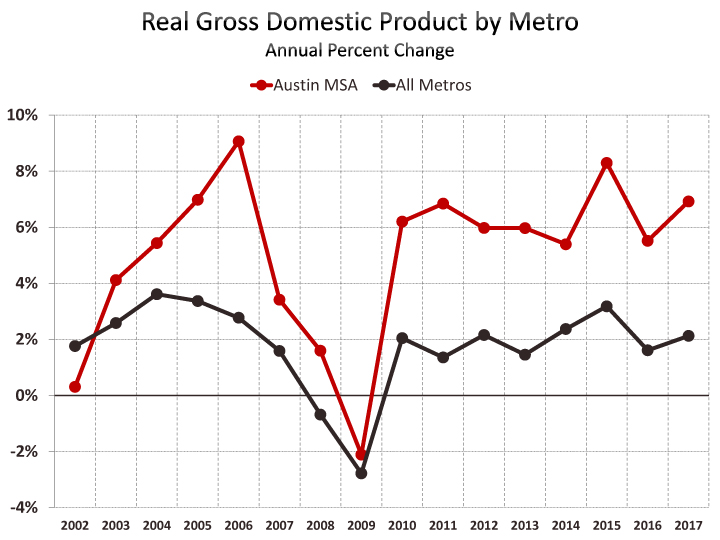

Austin’s economy grew 6.9% in 2017 according to new data on gross domestic product (GDP) by metro released late last month by the U.S. Bureau of Economic Analysis (BEA). Growth for 2016, which was previously stated as 4.9% has been revised to 5.5%. These growth rates are real, inflation-adjusted, rates. This year’s 6.9% growth is faster than any post-recession year except 2015.

Economic growth in 2017 across U.S. metropolitan areas was widespread. Of 383 metros, 82% saw real gains, compared to 77% in 2016. Aggregate growth for all U.S. metros rose to 2.1% in 2017 after increasing by 1.6% in 2016.

Austin’s 6.9% gain in real GDP is the second highest rate of growth among the 50 largest metro economies. Austin follows San Jose which grew by 7.6%. San Antonio grew 4.6% and ranked fourth and Dallas-Fort Worth’s 3.9% growth ranks sixth. Houston’s economy, which had negative growth of 3.6% in 2016, was effectively unchanged (up 0.03%) in 2017, ranking 48th.

For the metropolitan portion of the U.S. as a whole, and for Austin, 2009 is the recession low-point for real GDP and positive growth resumes in 2010. Over the last 5 years, real GDP is up 11.2% in the metropolitan portion of the U.S. In Austin, real GDP has grown 36.4% since 2012, making it the second fastest growing major economy—behind only San Jose. San Antonio (up 34.3%), Dallas-Fort Worth (up 22.6%), and Houston (up 6.8%) rank as the third, sixth and 39th fastest growing large metros for 2012-2017.

Austin’s current dollar GDP totals $149 billion in 2017, making it the 24th largest U.S. metropolitan economy. At the time of last year’s release of this data, Austin ranked 27th. On the basis of population in 2017, the Austin metro ranks 31st.

While 82% of all metropolitan economies grew in real terms in 2017, 96% of the 50 largest metros grew (only New Orleans and Bridgeport had negative growth in 2017). In aggregate, their growth was 2.4%, slightly greater than the 2.1% real gain for the entire metropolitan portion of the U.S. The 50 largest metros account for 73% of U.S. metropolitan area GDP.

Per Capita GDP

Austin’s real GDP on a per capita basis performed well relative to other large metros over both 2016-2017 and 2012-2017. Austin ranks second with 4.1% real growth in per capita GDP in 2017, while the growth for all metros was 1.3%. Since 2012, real per capita GDP is up 18.3% in Austin, making it the fourth best performing large metro. Across all metros, 2012-2017 growth was 6.5%. Gains in real GDP on a per capita basis reflect improvement in an area’s standard of living.

The pre-recession peak for real per capita GDP across all metros was 2007. For the metropolitan portion of the U.S., 2017 per capita GDP just surpasses 2007 by 3.6%. Of the 50 largest metros, 18 still have real per capita GDP that is lower than what it was in 2007. San Jose (up 44.0%), Pittsburgh (up 22.9%), and Austin (up 21.7%) lead all major metros for real per capita gains since 2007. Five large metros have real per capita GDP in 2017 that is more than 10% below the level of 2007: Las Vegas, New Orleans, Bridgeport, Phoenix, and Orlando.

GDP by Industry

All private industry sectors, except nondurable goods manufacturing, contributed positively to U.S. metropolitan area real GDP growth of 2.1% in 2017. Professional and business services, wholesale and retail trade; and financial activities made the greatest contributions to growth of U.S. metros in aggregate. Information only accounts for 5.2% of GDP for the metropolitan portion of the U.S., but it was the fastest growing industry sector in 2017, with 4.1% real growth.

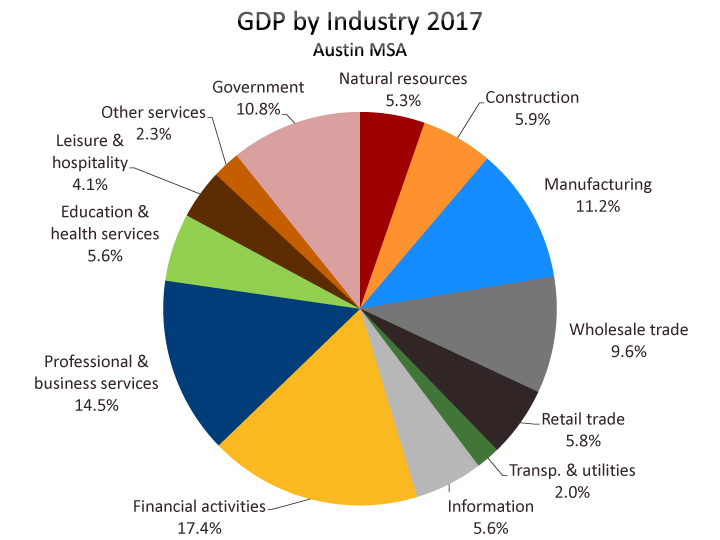

In Austin, where real GDP growth was 6.9%, wholesale and retail trade contributed the most to growth (1.45 percentage points), followed by natural resources and mining (1.22) and financial activities (1.14).

Wholesale and retail trade makes up 15.4% of Austin’s GDP and real growth was 9.6% in 2017.[1] Natural resources and mining makes up 5.3% of GDP and real growth was 31.4%. Financial activities, Austin’s largest industry, makes up 17.4% of GDP and real growth was 6.5%.[2] After financial activities, Austin’s largest industries are professional and business services (14.5% of the region’s GDP) and manufacturing (11.2% of GDP)[3]. These sectors grew by 5.9% and 5.8% respectively in 2017.

Houston, the seventh largest metro economy, did not grow in 2017. Natural resources and mining(2.72 percentage points), construction (1.46), and nondurable goods manufacturing (1.49) contribute positively, but the remainder of the major industry sectors contributed negatively.

Dallas-Fort Worth, the fourth largest metro economy, ranked sixth for growth in 2017. The metro’s 3.9% gain was driven by financial activities (1.06) and natural resources and mining (0.81). Only nondurable goods manufacturing contributed negatively (-0.12).

San Antonio (ranking 34th largest) had real growth of 4.6% (fourth fastest) and the largest contributors to growth in 2017 were natural resources and mining (2.47) and financial activities (0.63).

[1] In Austin in 2017, 62% of the trade sector is wholesale trade and the balance is retail. For the metro portion of the U.S., 51% of trade is wholesale.

[2] In Austin, 32% of the financial activities sector is made up of finance and insurance and the remainder is real estate, rental and leasing. For the metropolitan portion of the U.S., 36% of the sector is finance and insurance.

[3] In Austin, manufacturing is 80% durable goods and 20% nondurable goods. For the metropolitan portion of the U.S. manufacturing is 55% durable and 45% nondurable.